Understanding Your Workers Compensation Premium

PART B:

Experience Mod Factor

A quick review:

We now know that class codes are used across the insurance industry to categorize different jobs by the risk of the work performed by employees. Class codes are factored into your premium calculation to account for the likelihood of injury for that category of work.

We continue our review of the key cost-driving factors by delving into the second factor in premium formulation – the Workers Compensation Experience Modification (Mod).

The Basics:

The workers compensation “experience modification number” is a rating prepared by the National Council on Compensation Insurance (NCCI). A handful of states use their own system, but we’ll concentrate on NH where NCCI prepares it.

Based on a 3 year period, companies that have paid at least a certain amount in work comp premium, receive mandatory experience rating.

The Purpose

What is the purpose of the experience rating? Insurance companies are able to take on your individual risk at a reasonable cost by spreading or sharing your risk with other customers within your industry. This is a basic

mechanism of insurance.

In a sense, you are not paying premiums just to cover your potential annual losses. Your premium will help to

pay losses accrued by everyone. Let’s say you were loss-free in 2016. Then in 2017 you have a loss that is almost twice your annual premium. Carriers will be able to cover your 2017 loss because of the other companies who, similar to your 2016 year, have contributed more premium than the cost of their losses. That surplus is what carriers use to pay for that big loss of yours in 2017.

In our review of class codes, we discussed that different occupations present different levels of risk. In a similar fashion, each employer presents a different level of risk compared to others in their industry. Two different general contractors can have very different approaches to safety and training. Those two contractors still fall into the same class code, so class codes alone clearly fail to capture the whole story. That’s where your mod factor comes in; to illustrate your operation’s unique level of risk based on your recent history.

Your premium

Your Mod compares your actual claims history to your expected claims history based on your size and industry.

If your claims are higher than expected, you will be given a debit Mod (greater than 1.0); if your claims are lower than expected, you will be given a credit Mod (below 1.0); and if your actual claims match your expected claims, your Mod is neutral at 1.0

As you may expect, it’s a lot more complicated than that quick overview but this explanation is intended for the purpose of understanding the basics.

In Practice

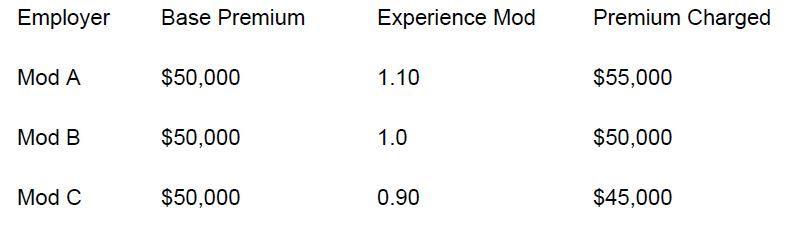

To Illustrate how your Mod affects your premium, let’s take a look at a few scenarios:

Now you have a broad-brush understanding the purpose of experience modification numbers, but the question remains; Why does knowing this help you?

Your Mod has a direct impact on your premium. The fact that you actually have some degree of control over it, makes it notably important. If you pay attention and employ loss management strategies, your Mod will probably stay low.

Here are some things you can do to keep your experience modification number low:

Keep tabs on it:

Review your NCCI report with your agent/broker at least annually to stay on top of how your Mod is trending and make sure the data is accurate.

File claims quickly:

Have an efficient procedure for filing claims. The sooner the provider is notified, the sooner a claims professional can begin to validate the claim, determine and approve benefits, verify and monitor medical expenses, and do what they can to help your employee get back to work. Which brings us to..

Get employees back to work quickly:

Adopt a return to work and/or temporary alternate duty (TAD) program in place to encourage employees to get back to work as soon as possible. The longer an employee is out of work, the harder it is to get them back. So get them back to work as soon as possible, even if it is only for a few hours a week or doing something that is outside of their normal duties.

Implement and monitor a safety program:

Make workplace safety a priority in your business. Not only will this help you maintain a healthy Mod but it may have the added benefit of creating a culture where your employees feel they are being cared for.

Incentivize time without incidents:

Small but more frequent claims will have more of an impact on your Mod than one large claim. One method to encourage safety in the workplace is by giving employees a special treat or a small bonus for reaching defined periods of time without and injury.

Get buy in from the top down:

In many organizations, the employees will not take these steps seriously unless their direct supervisor is taking it seriously. As the owner, partner, executive, or GM safety begins with you. Your managers and supervisors have to understand how important it is to the organization so they will, in turn, relay its importance to your lower level employees.